Investment Income — The Growing Problem

Baby boomers throughout Maryland are facing a two-pronged assault on their investment portfolios. As we all know, stocks have performed very poorly over the last ten years. Equally as important and probably less obvious is that investment income has been under assault as well. Not only have yields been falling, but during the last recession many companies cut their dividends. It has become very difficult to grow portfolios in the traditional way,and just as difficult to grow investment income. The importance of a growing income stream cannot be overstated, especially as baby boomers begin to retire. Growing investment income is a problem—and that problem in itself is growing.

With bond and money market yields near all-time lows, investors who are trying to generate more investment income feel like they are swimming upstream. In fact, many are coming to the realization that they may not be able to afford to retire when they want to because their retirement income will not be enough to support their lifestyle. Studies show that a 4% withdrawal rate is just about the maximum allowable before running out of money becomes a possibility. Simple math tells us that for each $1 million of savings, a retiree can spend $40,000. Until recently, investors could count on the bond market to provide them with a steady stream of consistent, stable income that easily achieved the 4% withdrawal threshold without taking on much risk. A relatively small percentage of stocks in the portfolio would provide some growth to offset the effects of inflation. But the good ol’ days of this kind of investing may be behind us.

[blockquote4]Maryland investors do not have to look far to find some excellent options within the equity market.[/blockquote4]When the U. S. financial crisis and subsequent recession arrived, the stock market was hit hard and bond yields moved down to historically low levels. Some pundits are referring to this low interest rate environment as the “new norm”. We only need to look at the historical yield of the 10-year U.S. Treasury Note to see what has happened. Yields have been trending down for many years but recently that downward trend accelerated. In this lower interest rate environment, it is extremely difficult for investors who rely on income to maintain their way of life. As bonds with 5% coupons mature, investors are faced with the prospect of replacing those bonds with a 2.5% yield to maturity. Yield to maturity is essentially the rate of return an investor will receive if the bond is held to maturity. Sure, investors can purchase bonds with 5% coupons today, but will pay a very steep premium on them. Prevailing rates of 2.5% are well below the 4% level needed to support the value of the portfolio. The “new norm” does not bode well for income-oriented investors. Investors must approach their investments in a different way.

In the above scenario, not only is income halved but “real” rates of return are negative. In a bond portfolio, one basic goal is to have a positive “real” rate of return. For the real rate to be positive, a bond’s yield to maturity must be greater than the rate of inflation. This positive “real” rate of return maintains the buying power of investors’ money. For example, the old expression “a million dollars isn’t what is used to be” is the result of inflation. Positive real rates of return avoid this problem. The current level of inflation is in fact lower than the yield to maturity on the 10-year Treasury. However, the long-run rate of inflation is higher, at about 3%. Keeping up with inflation becomes nearly impossible without considering other options for your money.

So what should Maryland boomers and others who are trying to generate income do with bond and money market yields near all-time lows? Getting a little more creative in your investment strategies is the first step. Although the best option appears to lie in stocks, there are other choices worth considering. I would say, if given the choice between a 10-year Treasury with a 2.5% yield to maturity and an attractively priced stock with 3% or greater yield, I would take the stock every time.

But it doesn’t have to be a choice between bonds or stocks. There are other securities that should be con – sidered. Preferred stocks still offer attractive yields. Preferred stocks are securities that companies issue that entitle the holder to receive a set dividend payment with higher priority than common stock holders. This makes the dividend stream somewhat less risky than that of the common shares. They are typically less liquid, sometimes trading fewer than 1,000 shares per day, but offer lower levels of volatility. Convertible preferred securities, another type of preferred, may also be a good option. These are securities that offer a conversion privilege to the holder, allowing them to convert their shares into the common stock of the issuer. This conversion feature can increase the volatility of the security depending on the issuer’s underlying stock. These securities can also provide very attractive yields to investors. It is extremely important that investors understand what they are buying before they purchase the securities. Be sure to research the issue, the issuer and the tax implications before buying these securities.

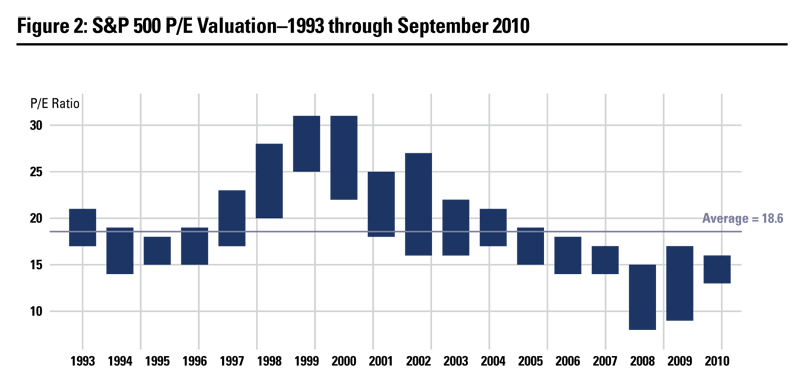

While these options may have a role in your portfolio, stocks seem to be the best option at this time. Not only are there many stocks currently offering yields greater than that of the 10-year Treasury, but they are relatively cheap as well. As you can see from the graph, price- earnings multiples are very low compared to where they have been in recent history. In fact, if you take away the recent market lows experienced in late 2008 and early 2009, the forward price-earnings multiple is lower than that of any other prior year shown. With stock valuations relatively low and bond yields near all-time lows, stocks should perform well over the long term. Moreover, stocks with higher yields offer a very compelling solution to the growing income problem.

Maryland investors do not have to look far to find some excellent options within the equity market. Many Maryland companies managed their way through the recession extremely well. Moreover, some offer investors an excellent opportunity for growth and pay attractive dividends to shareholders.In last year’s publication, I highlighted several Maryland companies including Lockheed Martin (LMT). The article “Value Investing or Investing for Value” attempted to point out the difference between buying “value stocks” and those that offer good value. For an investor looking for income, Lockheed Martin may fit the bill quite well. Currently, the stock offers a 4.3% yield and a price-earnings multiple of just 9 times next year’s Wall Street consensus earnings. Moreover, the company has consistently increased the dividend each year over the last decade. As long as investors keep to the 4% withdrawal rate, the movement of the stock price becomes a little less important. As long as the dividend is maintained and increased at least to match the rate of inflation, income investors should be quite happy.

Another Maryland company that might be a good fit for income investors is Corporate Office Properties (OFC).

Corporate Office Properties is a very well-managed real estate investment trust (REIT). REITs use investors’ pooled capital to purchase real estate. REITs receive special corporate tax treatment by virtue of paying out 95% of their profits in the form of dividends. Corporate Office Properties is attractive because a large percentage of its properties are leased by the government or companies that service the government. The company has consistently grown the dividend over the years and currently provides investors with a 4.3% yield.

Diversification within a portfolio is very important to mitigating risk. It is not advisable to overload a portfolio with too much of one thing. Not only does that apply to sectors of the market, like REITs, but it also applies to having too many high-yield securities in general. There is nothing wrong with purchasing some stocks in the portfolio that have slightly lower yields but have a good chance of growing that dividend significantly. McCormick & Company (MKC) is a great example. It has increased its dividend by 68% over the last five years.Even though the yield on the stock is around 2.5%, it makes sense to put some stocks like McCormick in your income-oriented portfolio.

These are just a few local companies that offer excellent examples of how investors can solve the growing income problem. This issue is best approached by purchasing individual stocks. It is very difficult for mutual funds to generate the level of income that can be attained using individual stocks. Mutual fund management fees come directly out of the income investors are seeking. The average equity mutual fund now charges a little over 1.5%, straining its ability to offer yields above 4%.

Even at these very low yields, bonds still play an important part in an investor’s portfolio. They provide an excellent risk-reducing component of the portfolio when managed correctly. A properly diversified portfolio provides superior risk-adjusted returns. For this reason, bonds should not be abandoned. For income-oriented investors, total bond holdings should be reduced, with the proceeds shifted to other asset classes offering better income return potential.

[blockquote4]As baby boomers approach retirement, they face some very difficult financial decisions.[/blockquote4]Complicating this is the perfect storm of historically low interest rates and a stock market that hasn’t appreciated in ten years. If the current environment truly is the “new norm”, a more creative approach to investing may be called for. Using some of these income strategies might just allow investors to solve this growing problem and thus grow their investment income.

—as published in CFA Society Baltimore’s annual Baltimore Business Review